How much are your assets really costing you?

It is vital for businesses to unravel their hidden costs, so these can be managed.

Shoppers are always looking for a bargain. Unfortunately, the true cost of a good becomes clear during use, when other expenses come to light. As a consequence, a savvy buyer needs to look ahead and understand the costs associated with their buying decision.

In a business context, a way to understand the true cost of an asset is through a life cycle cost analysis. This approach frames the cost of an asset from its purchase through its expected return/disposal. This framework is also known as the Total Cost of Ownership (TCO). In the IT sector, it has been in use since the 1980s, helping businesses understand the cost of their technological investments.

Unravelling your costs

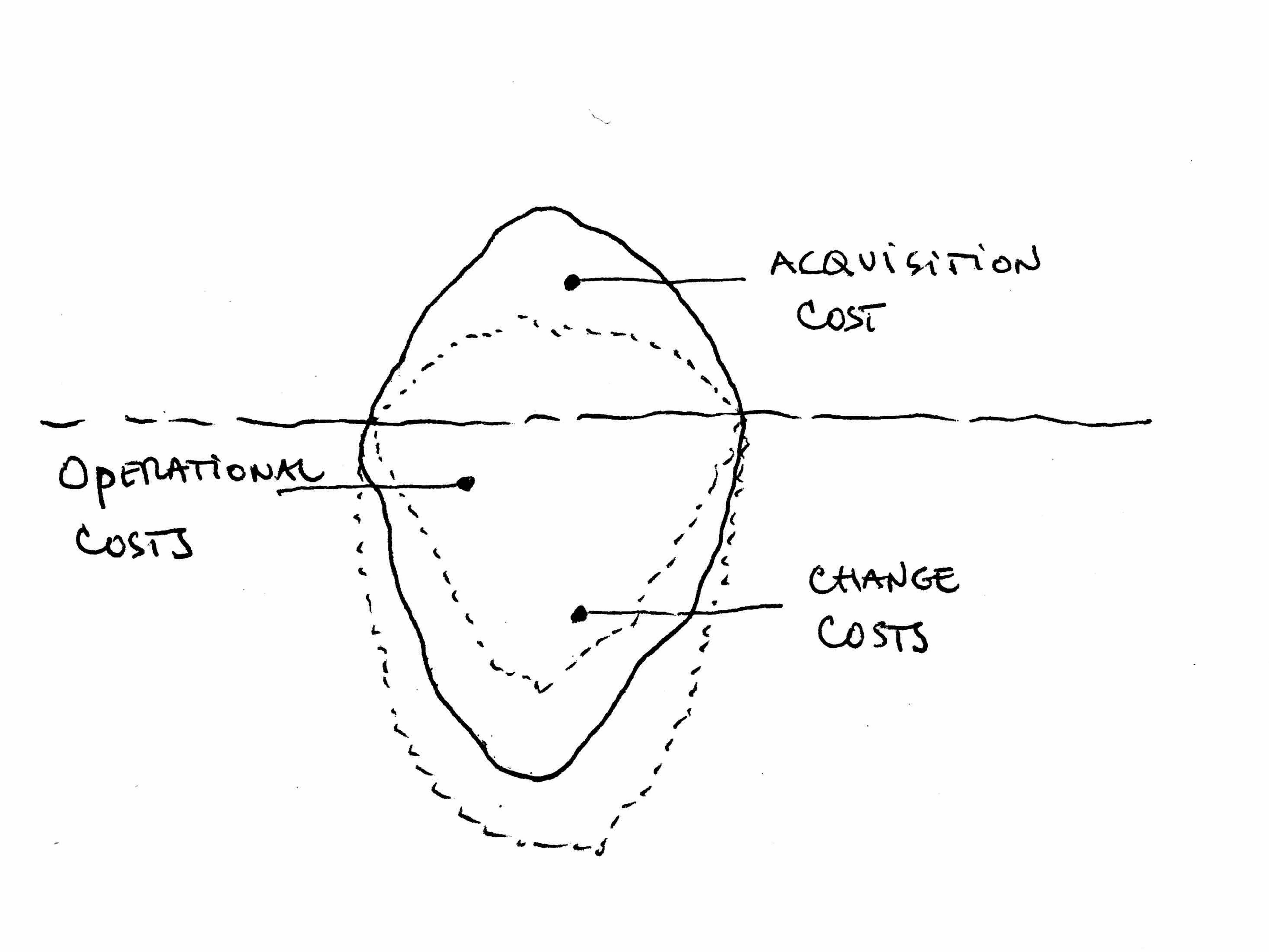

A way to understand the total costs of an asset can be exemplified through the image of an iceberg. What we see above the water are those obvious costs, like the purchase price and other expected expenses (i.e. warranty). These are also known as the acquisition costs and are what buyers usually focus on during negotiations. Below the water line are the hidden costs, incurred during the asset’s use or operation. These are neglected by most businesses because they are not evident.

When we think about reducing costs, we should be looking at ways to shrink the size of the whole iceberg. Unfortunately, as people are not aware of the hidden costs, their efforts focus on reducing the costs of acquisitions. Moreover, their attempts to produce short-term savings might increase the size of their hidden costs in the long run. Therefore, it is vital for businesses to unravel their hidden costs, so these can be managed.

Figure 1. The iceberg model: obvious and hidden costs of your assets

Organising your costs

When we look at an asset’s life cycle, there are three categories of costs associated with it: acquisition, operation, and change. As discussed above, the acquisition costs include the purchase price and other planned costs, such as warranties or regular maintenance. The operational costs include the bulk of the hidden costs. These depend on accounting for the consumption of materials and energy to operate the assets, preventive maintenance or repairs, insurance costs associated with user behaviour, taxes, and other unforeseen costs. Finally, change costs could include expenses related to the way you work and training.

Table 1. Cost Categories and Types

Understanding these types of costs can help businesses make smarter decisions when planning and budgeting. Of course, costs are only a part of the business plan. The creation of revenues is the main goal of a business, and understanding the cost structure can help shed light on the best strategy to deliver the most value based on trade-offs between revenue generation and incurred costs.